If you own a small business, then you know that every cent of your money counts. Not only do you have to find ways to increase your revenue. But you also have to reduce your liability and expenses. Unfortunately, as a small business owner, you do not have the luxury of hiring multiple individuals to take care of your taxes for you. You will have to do everything yourself if you want to ensure the smooth functioning of your business. It will also help in avoiding any legal actions from the authorities. However, before getting down to tax payments, you need to know about the type of taxes you will have to deal with while running a business. You will have to deal with four different tax types while operating a business-Sales tax, income tax, payroll tax, and property tax.

Businesses need to report their income every year and pay a specific amount of tax on it. It is known as income tax. If they have employees working for them, they need to pay an employment tax( payroll tax). Furthermore, the sales tax is something you pay to the government while selling your products. Property tax is the money you pay when you run your business from a purchased property. Now that you know of the different tax types.

Let us look at some ways to manage these taxes in 2021. You will not need an accounting or finance degree for it, but the right tools and a present mind. Take a look at some of these below.

- ALWAYS HAVE The PLAN TO PAY YOUR TAXES

It is always a dream come true for an entrepreneur to be an owner of a business. However, when you put a lot of effort into earning profits, it can sometimes make paying taxes a hassle. On top of that, there is no automatic process for business owners to pay their taxes. That is why they sometimes leave it till the end and forget about it. Delaying the payment of your taxes will put you in a position of extreme discomfort as you will have to deal with interest and penalties for the delay.

Although setting aside your tax money earlier requires patience and discipline, it will be beneficial for you to do so. For an exact determination of taxes, you can use a Freelance Income Tax Calculator and hire an expert to align technology and skills. You should file all your taxes quarterly to stay on the safe side, instead of waiting till the last day of the tax filing date. A wise decision is to pay the tax money using the online direct pay system of the IRS.

- FIND OUT IF YOU CAN QUALIFY FOR A DIFFERENT TAX TYPE

Businesses can file for a twenty percent deduction of their income when calculating their return. But that does not happen automatically. That only applies to business owners who file income taxes themselves rather than from their business. And, the applicability is on a few business types only. For example, if you run an accounting, medical, legal services business, expect a reduced tax deduction if you had an income of more than 326,000 dollars. Also, the service industry, where the profits are more than 426,000 dollars, will get no income tax deduction whatsoever.

While you might have tax advantages with your current business status, you should convert it to a C-corporation. According to the tax cuts and jobs act of 2017, you can also get a twenty-one percent tax deduction if you own a C-corporation business. That figure used to be thirty-five percent before it came into effect. After all, as a small business owner, you will welcome any tax deduction you can get.

- TAKE ADVANTAGE OF TAX DEDUCTIONS ON EQUIPMENT

You could have the chance to earn a tax deduction of around 1 million dollars if you purchase used or new equipment and use them in your business before the year-end. These deductions are for small businesses mostly. A wise decision would be to acquire equipment with the starting amount of 2,600,000 dollars and an ending amount of 3,600,000 dollars if you were to attain such a tax deduction.

You can also file for a one-hundred percent depreciation deduction if you bought specific equipment and used them after 27th September 2017. It applies to various types of new and used equipment. To know what these types of equipment are, you should go online and research or ask your local tax accountant.

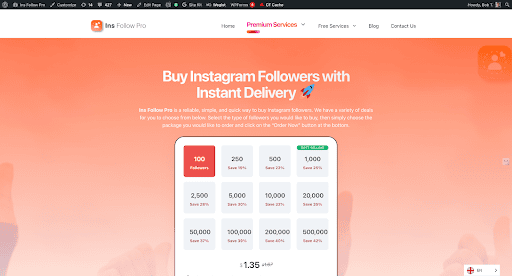

- USE AN EFFICIENT AND ACCURATE ACCOUNTING SOFTWARE

Every business has a different way of calculating its revenue and income. Most of them use QuickBooks accounting software or an accounting method when they receive money rather than when someone places an order and considers expenses when getting paid. Whatever accounting method you use at your business, smart owners are those who can adjust their accounting approach and report their income according to cash receipts. It will reduce their revenues at the end of the year, especially if they believe their income next year will be less than the previous year.

It is better to collect cash earlier instead of waiting for the calculation of the year-end expenses. It will allow you to utilize your current lower revenue situation. The same is applicable for equipment and office supplies. You can ask for a deduction on them if you are experiencing a higher revenue situation before the end of the year.

- GIVE CONTRIBUTIONS TO CHARITIES

Contributing a specific amount of money to charity will make you a model citizen. It will also allow your business to claim a tax deduction equal to the donated amount’s market value. However, if you are the owner of a pass-through company, you will have limited deduction ability in 2021. For married couples, the standard charity deduction amount is 24,000 dollars. And for individuals, it is 12,000 dollars.

For claiming this type of tax deduction, you will have the ability to write off gifts given to charity or 300 dollars in cash to specific creditable foundations. Before you give away charitable donations for tax deduction purposes, it is a wise decision to consult your tax accountant and come up with a donation strategy.

- UNDERSTAND THE TAXATION METHOD OF A PPP LOAN

During the Covid019 pandemic, the government handed out many PPP loans to various businesses, which allowed them to stay afloat during these worse economic times. Given out to cover salaries and pay for daily business operation costs, you might know that these loans are non-taxable. It is the case, but there are a few complications with the bigger picture.

Because according to the IRS, expenses such as payroll costs will not be up for a tax deduction if paid with the PPP loan amount. There is a debate going on in Congress about this scenario. The statement by the IRS and the one issued by the government contradicting each other. Until Congress comes up with a decision, prepare yourself to pay some extra taxes on your income.

CONCLUSION

Filing taxes on time is something that every business should do to avoid penalties and extra charges. Although numerous taxation strategies might help you out, not every one of them will apply to your business. It will be a wise decision to keep them in mind heading into the new tax year. If you cannot handle your taxes by yourself, hire a professional tax accountant for your business. They know all the latest taxation laws and will be able to guide you in a better way.